Stalingrad

Eternal Poster

- TS TS

- #21

Date: 07/03/2023

Session: London

Pair: NZD/JPY(New Zealand Dollar/Japanese Yen)

What time did you wake up: 6:00 AM

Time of Trade: 6:02 PM

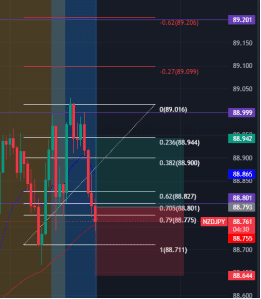

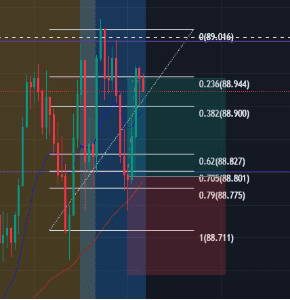

Setup:Regular Fibs Setup

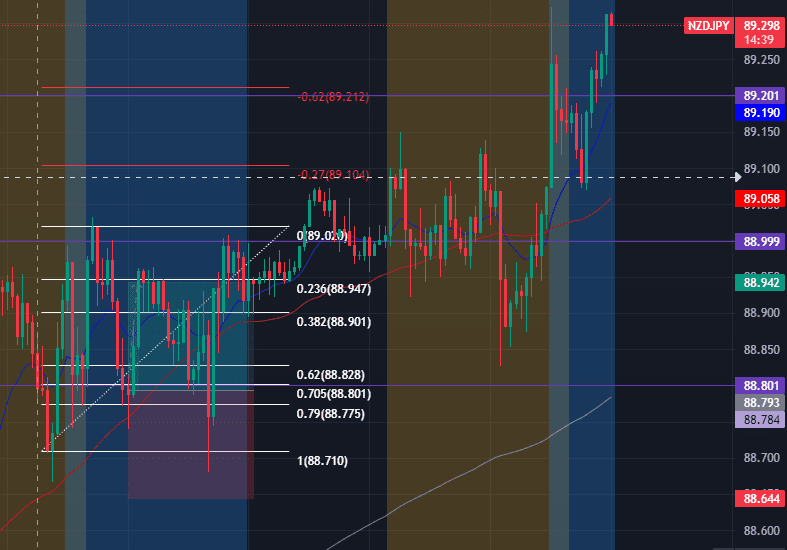

Trade Breakdown Analysis: Trending Environment(Bullish), Market structure break Upside, 800 institutional level acting as support plus the 50 SMA acting as dynamic support too. Currency Strenght meter indicating that the NZD is more stronger than the JPY pair. There is no strong news related to the both pair.

Emotions/Mindset during session: My emotion in this trade is that I am indifferent towards the trade. I accept the fact that it can go against me even though with my trading edge.

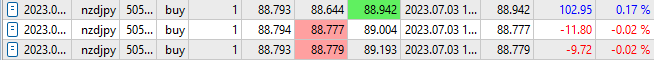

How many pips did you catch: 15 pips

Logging

Briefly explain the scenario: Trending Environment(Bullish), Market structure break Upside, 800 institutional level acting as support plus the 50 SMA acting as dynamic support too. Currency Strenght meter indicating that the NZD is more stronger than the JPY pair. There is no strong news related to the both pair.

What did you do correct: Checking the news and currency meter strength beforehand and trading within my session. The confluence is also aligned.

What mistakes did you make: N/A,

Your emotions before the trade: My emotion in this trade is that I am indifferent towards the trade. I accept the fact that it can go against me even though with my trading edge.

What was your confidence level scale 1-10: 10

How can you improve this: Always back-test the strategy

How many pips was the entire move: 31 pips

Where did it bounce: 0.79

How many pips did I get from it: 15 pips

Win or Lesson: Win

Add a screenshot of your trade or draw the pattern on your notebook:

Before: 6:10 PM

After Hitting My 1st TP: 6:30 PM

Today: 6:00 PM (nagtuloy-tuloy yung bullishness however nastop yung mga runner ko, all goods pa din as long na nasa profit side and di talo, always remember trading is all about consistency and good risk management.)

Changes: dahil laging nagkakaroon ng pullback si NZDJPY, nilagyan ko ng 1 pip allowance yung stop loss breakeven ko sa runner.

Note: Nabusy me sa duty ko sa hospital kaya di na ko nakakapagtrade, medyo choppy din yung market environment ni NZDJPY last week kaya di rin ako nagtrade.

Session: London

Pair: NZD/JPY(New Zealand Dollar/Japanese Yen)

What time did you wake up: 6:00 AM

Time of Trade: 6:02 PM

Setup:Regular Fibs Setup

Trade Breakdown Analysis: Trending Environment(Bullish), Market structure break Upside, 800 institutional level acting as support plus the 50 SMA acting as dynamic support too. Currency Strenght meter indicating that the NZD is more stronger than the JPY pair. There is no strong news related to the both pair.

Emotions/Mindset during session: My emotion in this trade is that I am indifferent towards the trade. I accept the fact that it can go against me even though with my trading edge.

How many pips did you catch: 15 pips

Logging

Briefly explain the scenario: Trending Environment(Bullish), Market structure break Upside, 800 institutional level acting as support plus the 50 SMA acting as dynamic support too. Currency Strenght meter indicating that the NZD is more stronger than the JPY pair. There is no strong news related to the both pair.

What did you do correct: Checking the news and currency meter strength beforehand and trading within my session. The confluence is also aligned.

What mistakes did you make: N/A,

Your emotions before the trade: My emotion in this trade is that I am indifferent towards the trade. I accept the fact that it can go against me even though with my trading edge.

What was your confidence level scale 1-10: 10

How can you improve this: Always back-test the strategy

How many pips was the entire move: 31 pips

Where did it bounce: 0.79

How many pips did I get from it: 15 pips

Win or Lesson: Win

Add a screenshot of your trade or draw the pattern on your notebook:

Before: 6:10 PM

After Hitting My 1st TP: 6:30 PM

Today: 6:00 PM (nagtuloy-tuloy yung bullishness however nastop yung mga runner ko, all goods pa din as long na nasa profit side and di talo, always remember trading is all about consistency and good risk management.)

Changes: dahil laging nagkakaroon ng pullback si NZDJPY, nilagyan ko ng 1 pip allowance yung stop loss breakeven ko sa runner.

Note: Nabusy me sa duty ko sa hospital kaya di na ko nakakapagtrade, medyo choppy din yung market environment ni NZDJPY last week kaya di rin ako nagtrade.

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.