J

Jeanh

Guest

It can be difficult to remember your passwords for every online account these days and many people now rely on the auto-fill function to store their details.

This feature means that once the credentials are entered they are saved and automatically added every time the user accesses the site.

But a new survey shows this habit is putting millions of people at risk and is leaving personal data exposed to cybercriminals.

Mobile and internet security company commissioned a study exploring the login preferences of 2,000 UK adults when browsing the web on a phone or tablet. They found a third of Brits login automatically and also store their bank card details to shopping sites like eBay and Amazon

Mobile and internet security company BullGuard commissioned a study exploring the login preferences of 2,000 UK adults using phones or tablets.

They found a third of Britons login automatically and store their bank card details to shopping sites such as eBay and Amazon, making them particularly vulnerable to attack.

Nearly two thirds of UK adults rely on 'auto-fill' to complete the login process for some or all websites.

With nearly half of people using their phone as the main way to access these accounts, losing their handset could prove disastrous.

'The results show that a large number of people are taking risks with sensitive data, largely for the sake of convenience,' said Cam Le, Chief Marketing Officer at BullGuard.

'We save login and bank card details often without a second thought, but with that comes the risk of what could happen should our mobiles or tablets fall into the wrong hands.

58 per cent of respondents stay signed-in to their email accounts permanently, despite the private and sensitive information potentially accessible. Only a fifth of respondents had installed security software on their phone

Nearly two thirds of people store their credit or debit card details on Amazon, over a fifth do the same for eBay and a third also save their card details on online payment service, PayPal. Furthermore, over a fifth of UK adults stay permanently logged-in to the payment service

'It's always important to make it is as difficult as possible for criminals to access personal and financial details, and that obviously includes those stored on personal devices.'

Additionally, less than half of people in the survey hadn't set up a passcode for their phone or tablet, meaning anyone who gets their hands on the device could access its contents freely.

By staying logged in to social media accounts like Facebook and Twitter, three in five make it easier for criminals to access their private data.

Over half of respondents stay signed-in to their email accounts permanently, despite the private and sensitive information saved in the accounts.

And nearly two thirds of people store their credit or debit card details on Amazon, over a fifth do the same for eBay and a third also save their card details on online payment service, PayPal.

TOP 10 SITES BRITS STORE THEIR BANK CARD DETAILS ON

1. Amazon - 64.13 per cent

2. PayPal - 32.90 per cent

3. eBay - 21.19 per cent

4. Tesco - 10.78 per cent

5. Argos - 9.85 per cent

6. Marks & Spencer - 9.48 per cent

7. Apple - 7.62 per cent

8. Rakuten - 6.88 per cent

9. Asda and NetFlix joint - both 6.69 per cent

10. ASOS - 6.51 per cent

TOP 10 SITES FOR STORING LOGIN DETAILS

1. Facebook - 60.12 per cent

2. Email provider - 35.28 per cent

3. Amazon - 33.97 per cent

4. Twitter - 26.69 per cent

5. eBay - 20.25 per cent

6. Instagram - 13.88 per cent

7. PayPal - 13.57 per cent

8. Google+ - 11.89 per cent

9. Pinterest - 9.13 per cent

10. LinkedIn - 9.05 per cent

Passwords can be difficult to keep track of, however.

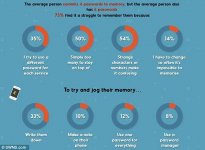

The typical Brit has approximately six different passwords and seven in 10 struggle to remember them.

On average, users have to request a new password every other month because they keep forgetting them and a third of respondents resort to writing their passwords down.

Eight in 10 of those polled said they use the autofill option 'purely for speed and convenience' while half say it's 'annoying to continually type passwords in.'

The typical Briton has approximately six different passwords and seven in 10 struggle to remember them. Brits have to request a new password every other month on average because they keep forgetting them, while a third of respondents resort to writing their passwords down

In addition to the wealth of private and financial information potentially available to opportunistic thieves, phones themselves aren't cheap, costing £194.09 ($276.21) on average. Despite this, little more than three in 10 people have insured their phone or tablet

More than half of respondents blamed forgetting passwords on websites which force them to use 'strange characters' or numbers.

In addition to the wealth of private and financial information potentially available to opportunistic thieves, the device itself isn't cheap, worth £194.09 ($276.21) on average.

But little more than three in 10 people have insured their phone or tablet.

'Given the sheer number of often complicated passwords we have to remember, it's perfectly understandable that many of us pre-store login details,' Cam Le added.

'But in light of the results of our study we'd advise people to be a bit more selective with the websites where they choose to do this.

'We'd particularly recommend that people memorise passwords for sites where they have saved financial information.

'Sites that don't reveal any potentially sensitive data are lower risk. Hopefully with this middle ground, people can still enjoy a comfortable and safe environment online.'

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.